Canada

As a part of our global ZOLL family, we provide all the benefits you need to stay physically and financially healthy now and in the future. Below is a summary of the benefits available to ZOLL employees in Canada. Please review them carefully to discover the value these plans bring to your life. The Benefit Period is January 1 – December 31 (Calendar Year). For more information, review the Empire Life Employee Benefits Booklet.

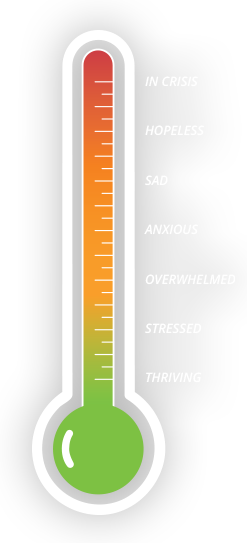

How are you?

Your emotional well-being is key to helping you focus on daily tasks, tackle problems as they arise, and relate with those around you.

We’re Here for You! ZOLL Benefits offers you and your family resources and support when you need it most.

- Call or text 988 to reach the Suicide Crisis Helpline.

- Contact Teladoc Medical Experts’, Mental Health Navigator for personalized support with a licensed clinician to connect you with the best resources for your condition.

- Contact Telus Health (formerly LifeWorks) who can guide you to the best care path for your needs.

To complement your provincial health care insurance plan, ZOLL provides Extended Health Care (EHC) through Empire Life, which covers a variety of treatment and supply expenses. These expenses include prescription medicines, semi-private and convalescent hospital accommodations, supplementary health services, and medical supplies. Coverage also includes services such as acupuncture, audiology, chiropractic, podiatry, speech therapy, and more (see Empire Life Employee Benefits Booklet).

For more information view the medical coverage chart below for Empire Life Extended Health Care.

Empire Life Extended Health Care

| Plan Features | Benefit |

|---|---|

| Major Medical | The plan pays 90% |

| Diagnostic tests | $500 per benefit period |

| Hearing aid | $500 per 60 consecutive months |

| Private duty nursing | $10,000 per benefit period |

| Paramedical (i.e. Acupuncturist, Audiologist, Chiropractor, Clinical Psychologist, Dietician, Massage therapist, Naturopath) |

The plan pays 90%; $500 per practitioner per benefit period |

| Hospital | Semi-Private Room: The plan pays 100% Convalescent: The plan pays 90%; $40 per day, 180 days per claim |

| Prescription Drugs | The plan pays 90%; dispensing fee is not covered; mandatory generic* Smoking Cessation Drugs: $300 lifetime maximum |

*While generic drugs are mandatory across the industry, if necessary, your doctor may prescribe non-generic medications.

TELADOC

Your Empire Life medical coverage provides access to Teladoc, which includes:

- Teladoc Medical ExpertsTM – Connect with experts to find the right specialist.

- Teladoc also offers Telemedicine with 24-7 virtual access to Canadian-licensed physicians for physical, non-emergency related health issues such as allergies, sinus infections, flu systems, and much more.

- Mental Health Navigator – Contact Teladoc’s benefits specialists for help navigating complex mental health care needs and to find guidance for the appropriate level of care.

Take control of your health with the help of Teladoc’s Medical Experts who can offer second opinions, help finding a provider or specialist, even outside of Canada, explain health care topics to make more informed decisions, and compile up to 3 years of medical records into one convenient e-file. All services are completely confidential.

Teladoc offers convenient, 24/7 telemedicine with access to quality health care when and where you need it most. By scheduling a visit with a Canadian, board-certified, and licensed medical doctor, you can be diagnosed, treated, and prescribed medication, if necessary. Please note that Teladoc does not prescribe drugs covered by the Controlled Drugs and Substances Act.

Mental Health Navigator is a virtual service that supports plan members who are struggling with a mental health issue. It’s a confidential, compassionate resource to guide you to appropriate care —whether you are experiencing stress, anxiety, depression, or another issue.

Contact Teladoc’s benefits specialist and a nurse or physician will reach out to you and recommend either a psychologist, therapist, or psychiatrist. Your first consultation is free. Follow-up appointments will be processed through your health benefits.

Get started today.

Visit member.teladoc.ca or call 1-877-419-2378 to contact a Teladoc Medical Expert or Mental Health Navigator, or download the Teladoc app to speak to a doctor.

To learn more, review the frequently asked questions:

Telemedicine FAQ

Mental Health Navigator FAQ

Good oral health is essential to your overall physical wellbeing. ZOLL provides quality dental coverage through Empire Life. You receive benefits for basic and restorative care, periodontics and endodontics, major restorative services, and orthodontia coverage.

Empire Life Dental

| Plan Features | Benefit |

|---|---|

| Basic Restorative | The plan pays 90% |

| Periodontics/Endodontics | The plan pays 80% |

| Major Restorative | The plan pays 50% |

| Benefit Period Maximum | $1,500 combined maximum |

| Orthodontics | The plan pays 50%; $1,000 lifetime maximum |

For more information on coverage provided through Empire Life, view the vision and dental coverage charts.

Routine eye exams and vision services are covered at 100% up to specified plan maximums. Vision coverage is outlined below and provided through Empire Life.

Empire Life Vision

| Plan Features | Benefit |

|---|---|

| Routine Eye Exam | The plan pays 100% ($75, 1 per 24 consecutive months) |

| Frames and Lenses | $300 combined maximum allowance per 24 consecutive months (per 12 consecutive months if under age 18) |

| Special Contact Lenses | $300 combined maximum allowance per 24 consecutive months (per 12 consecutive months if under age 18) |

For more information on coverage provided through Empire Life, view the vision and dental coverage charts.

You automatically receive life and accidental death & dismemberment insurance through Empire Life. The plan pays 1 times your annual salary up to a maximum of $750,000. Your coverage is effective on your date of hire and is paid for by ZOLL.

Your spouse and children also receive life insurance benefits as no cost. The policy through Empire Life provides $5,000 to your spouse and $2,500 to each dependent child. Coverage will end when the employee turns age 70 or when employment with ZOLL.

Definition of a Member

You are eligible for Short-Term Disability (STD) coverage if:

- You are an active employee of ZOLL Canada and working at least 25 hours per week.

- Have been employed by ZOLL Canada for 3 months of continuous and full-time services.

Eligibility Waiting Period

You are eligible for benefits on the first day following 90 days of service.

Premium Contribution/Benefits

The cost of this insurance is paid for by your Employer, and benefits are payble through ZOLL Canada.

Benefit Amount

Weekly STD Benefit:

- 75% of your weekly earnings

- To a weekly maximum of $1,575

Benefit Waiting Period

The Benefit Waiting Period is the period you must be continuously disabled before STD benefits become payable.

- If your Disability is caused by an accident, Your Waiting Period is: 5 days

- If your Disability is caused by physical disease, or mental disorder: Your Waiting Period is: 5 days

Definition of Disability

You are disabled if you meet the following Own Occupation definition of disability.

- You are Disabled from your Own Occupation if, as a result of Physician Disease, Injury, or Mental Disorder:

- You are unable to perform with reasonable continuity the Material Duties of your Own Occupation; and

- You suffer a loss of at least 20% in your Indexed Predisability Earnings when working in your Own Occupation.

Maximum Benefit Duration

If you meet the definition of disability you may receive a benefit for 17 weeks or to the date LTD benefits become payable.

Questions

If you should have any questions about your coverage or how to enroll, please contact your Plan Administrator.

If you are ill or injured and unable to work, long-term disability provides income protection. The benefit covers 66.67% of your gross monthly salary, rounded to the next $1, to a maximum of $16,500 per month.

ZOLL Medical offers an exclusive employer-matched group retirement savings plan to all eligible employees. The plan is administered by Sun Life. Members of this plan also have one-on-one access to a Certified Financial Planner to help answer questions directly related to your group retirement savings plan investment accounts or general financial wellbeing.

The ZOLL Medical group retirement savings plan is made up of two investment accounts: a Registered Retirement Savings Plan (RRSP) and a Deferred Profit Sharing Plan (DPSP). Your contributions are made into the RRSP and ZOLL’s matching contributions are made into the DPSP. You can enroll as soon as you have reached three months of continuous employment with ZOLL Medical. Once enrolled, you can select regular contributions up to 6.25% of your earnings which are made directly from your paycheque into your RRSP. Contributions are made on a pre-tax basis, which means more of your hard-earned savings are invested and growing sooner. ZOLL Medical will match 100% of your contributions up to 6.25%, however, you can choose to contribute more than 6.25% into your RRSP on a voluntary, unmatched basis up to your personal RRSP contribution limit. This can be found on your Notice of Assessment provided by the Canada Revenue Agency.

To learn more about the ZOLL Medical group retirement savings plan, please request an electronic copy of the Member Booklet.

ZOLL encourages personal and professional development through continued education. You may receive non-taxable reimbursement up to the maximum of $7,000 CDN per calendar year for eligible courses. Once you complete the course, submit the Tuition Assistance Form with a copy of the bill, proof of payment, and grade transcript.

You and your family have free, 24-hour daily support through Telus Health (formerly LifeWorks) to help you with all of life’s questions, issues, or concerns. Whether you need assistance with family issues or want help navigating changes at work, Telus Health provides confidential care online and by phone.

Find out more at 1-877-207-8833 or telus.com/en/health (User ID: zoll / Password: eap).