Preparing for Retirement

Wherever you are in your journey through life, every goal begins with a solid plan — and retirement is no exception. As Mark Twain wisely said, “Twenty years from now, you will be more disappointed by the things you didn’t do than by the ones that you did do.”

It’s YOUR Journey

Starting your career is an exciting yet overwhelming time filled with possibilities. As you embark on this journey, it’s essential to develop the skills and financial habits that will support you throughout your life.

Before you can plan effectively, take a moment to define your dreams and priorities. Do you envision:

- Starting a family?

- Furthering your education?

- Traveling the world?

- Pursuing a passion project?

- Spending quality time with loved ones?

- Giving back to your community?

These aspirations will form the foundation of your journey and guide your financial planning.

Start with a Vision

Just like building a house requires a blueprint, planning for your future needs a clear vision. Here’s why it matters:

- Clarity: A defined destination makes your path smoother.

- Motivation: Your ‘why’ keeps you focused and inspired.

- Personalization: Your plan should evolve with your experiences and interests.

Effective planning today can lead to a comfortable future, allowing you to pursue what you love without stress. Even small changes can make a significant impact over time. Leveraging the tools and resources offered by ZOLL Benefits can start you on your way to success.

Manage Your Finances

When should I start saving?

Your 20’s and 30’s are the perfect time to start saving, but if you’re getting a later start, don’t worry — it’s never too late. The key is to be proactive and make the most of every opportunity to accelerate your savings.

- Identify your financial needs for your journey and start saving now to bridge any gaps. Fidelity and CAPTRUST can help:

- Visit NetBenefits.com to take the financial wellness checkup – learn how to budget and create a financial plan.

- Schedule a one-on-one with a CAPTRUST advisor to develop your personalized Retirement Blueprint.

- Maximize your retirement contributions at ZOLL — one of the simplest and most tax-efficient ways to grow your savings.

- Boost your 401(k) Savings Plan effortlessly by enrolling in ZOLL’s automatic annual contribution increase program on NetBenefits.com, ensuring your contributions grow each year.

- Consider enrolling in the ZOLL Saver Plan with HSA if it is the right fit for you. You can contribute to the Health Savings Account (HSA) allowing you to save tax free for future (or current) medical expenses.

Be Prepared for an Emergency

Start building your safety net today and enjoy peace of mind knowing you’re ready for whatever life brings. An emergency fund is a vital resource at every stage of life. Life can be unpredictable, with unexpected events like job loss, illness, or global crises potentially impacting your income. To make saving easier and ensure you’re prepared for the unexpected, consider setting up automatic transfers from your checking account to your savings account.

A good credit score is essential for securing affordable financing, which can help you achieve long-term goals like buying a home. Consider these options to build a strong credit foundation:

- Focus on paying bills on time.

- Catch up on overdue balances.

- Avoid excessive credit inquiries and high balances.

- Regularly monitor your credit report to detect any errors or signs of fraud.

Does Anyone Like the Word Budget?

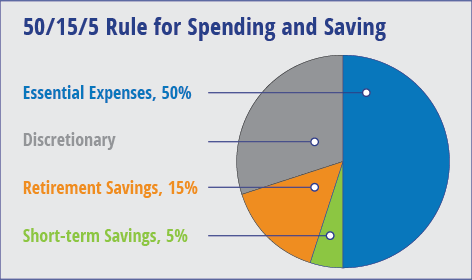

Creating a budget is a crucial step toward financial stability and achieving your long-term goals. While the word “budget” might not excite everyone, having a plan for your money can reduce stress, help you avoid debt, and set you up for future success. But what if we could make budgeting feel less restrictive and more empowering? After significant research, Fidelity developed the 50/15/5 rule — a simple guideline for saving and spending that can help you take control of your finances:

- Aim to allocate no more than 50% of your take-home pay to essential expenses.

- Save 15% of your pretax income for retirement.

- Keep 5% of your take-home pay for short-term savings.

While your personal situation may differ, this framework offers a solid starting point for managing your money effectively. By following this guideline, you can ensure you’re covering your needs, preparing for the future, and still have room for flexibility in your spending.

- Click here for an interactive budget worksheet from Fidelity.

- Explore the Fidelity Savings and spending check-up to see where you stand on the 50/15/5 rule.

Essential Expenses: 50%

Some expenses simply aren’t optional — you need to eat, and you need a place to live. Consider allocating no more than 50% of take-home pay to “must-have” expenses, such as:

- Housing – mortgage, rent, property tax, utilities (electricity, etc.), homeowners/renters’ insurance, and condo/home association fees.

- Food – groceries only; do not include takeout or restaurant meals, unless you really consider them essential, i.e., you never cook and always eat out.

- Health care – out-of-pocket expenses (e.g., prescriptions, copayments).

- Transportation – car loan/lease, gas, car insurance, parking, tolls, maintenance, and commuter fares.

- Childcare – day care, tuition, and fees.

- Debt payments and other obligations — credit card payments, student loan payments, child support, alimony, and life insurance.

Establish a Plan for Repaying Debt

If you’ve accumulated student loans or credit card debt, especially due to high tuition costs, it’s important to establish a repayment plan as part of your overall budget. Consider these approaches to pay off your debt faster:

- Debt Consolidation: Combine multiple debts into a single loan, potentially with a lower interest rate.

- Accelerated Repayment: Make larger or extra payments toward the principal when possible.

- Prioritize High-Interest Debt: Focus on paying off debts with the highest interest rates first.

- Budget for Debt Repayment: Allocate a specific portion of your income to debt reduction each month.

By implementing a structured plan, you can work toward becoming debt-free more quickly and efficiently.

Keep it Below 50%:

Just because some expenses are essential doesn’t mean they can’t be adjusted. Small changes can make a big difference. Consider simple tweaks like:

- Lowering your thermostat a few degrees in winter and raising it in summer.

- Buying groceries on sale and stocking up.

- Opting for frozen fruits and vegetables instead of fresh.

- Packing your lunch for work.

These minor adjustments can add up over time.

Retirement Savings: 15%:

It’s important to save for your future — at every age. Here’s why:

- Social Security alone is unlikely to fully fund the retirement lifestyle most people envision. Fidelity estimates suggest that about 45% of retirement income will need to come from personal savings.

- Consider saving 15% of your pretax household income for retirement. This includes both your contributions to your 401(k) and any employer matching funds.

- The keys to building a robust retirement fund are:

- Start early.

- Save consistently.

- Invest wisely.

- Maximize your savings potential by utilizing tax-advantaged retirement accounts such as 401(k)s, 403(b)s, or IRAs.

Remember, it’s never too early or too late to start planning for your financial future. The sooner you begin, the more time your money has to grow.

How to Get to 15%:

Saving 15% of your income for retirement might seem challenging at first, but there are strategies to help you reach this goal:

- Gradual Increase: ZOLL’s 401(k) Savings Plan offers a program that allows you to automatically increase your contributions annually until you reach your target savings rate. This allows you to start small and build up over time.

- Maximize Employer Match: Begin by contributing at least enough to take full advantage of your employer’s matching program. This is free money for your retirement. ZOLL offers up to 5.5% in matching contributions (100% of the first 4% and 50% of the next 3%).

- Leverage Raises and Bonuses: When you receive a salary increase or bonus, consider directing some or all these extra funds into your retirement accounts. This can help you boost your savings without feeling a pinch in your regular budget.

- Aim for Contribution Limits: As your savings ability grows, work toward maxing out your annual contribution limits for workplace savings plans or individual retirement accounts.

Remember, every step toward saving, no matter how small, is progress toward a more secure financial future.

Short-term Savings: 5%

Short-term savings, also known as emergency savings, are necessary for everyone. Life’s unexpected events — like illness or job loss — can be stressful enough without the added burden of financial strain. Start by setting aside $1,000, then gradually build up to cover three to six months of essential expenses such as housing, food, and utilities. Treat emergency savings like a monthly bill until you’ve reached your goal.

Plan for smaller surprises, too. In addition to major emergencies, it’s helpful to save a portion of your income for smaller unplanned expenses. Think wedding invitations, cracked phone screens, flat tires, or overlooked costs like car maintenance, kids’ field trips, doctor copays, and holiday gifts.

How to Get to 5%:

Make saving automatic. Setting up automatic transfers from your paycheck to a separate account dedicated to short-term savings can help you reach your goal of saving 5% of your income for life’s everyday surprises.

Start Now, Thank Yourself Later: Why Retirement Planning Matters Today

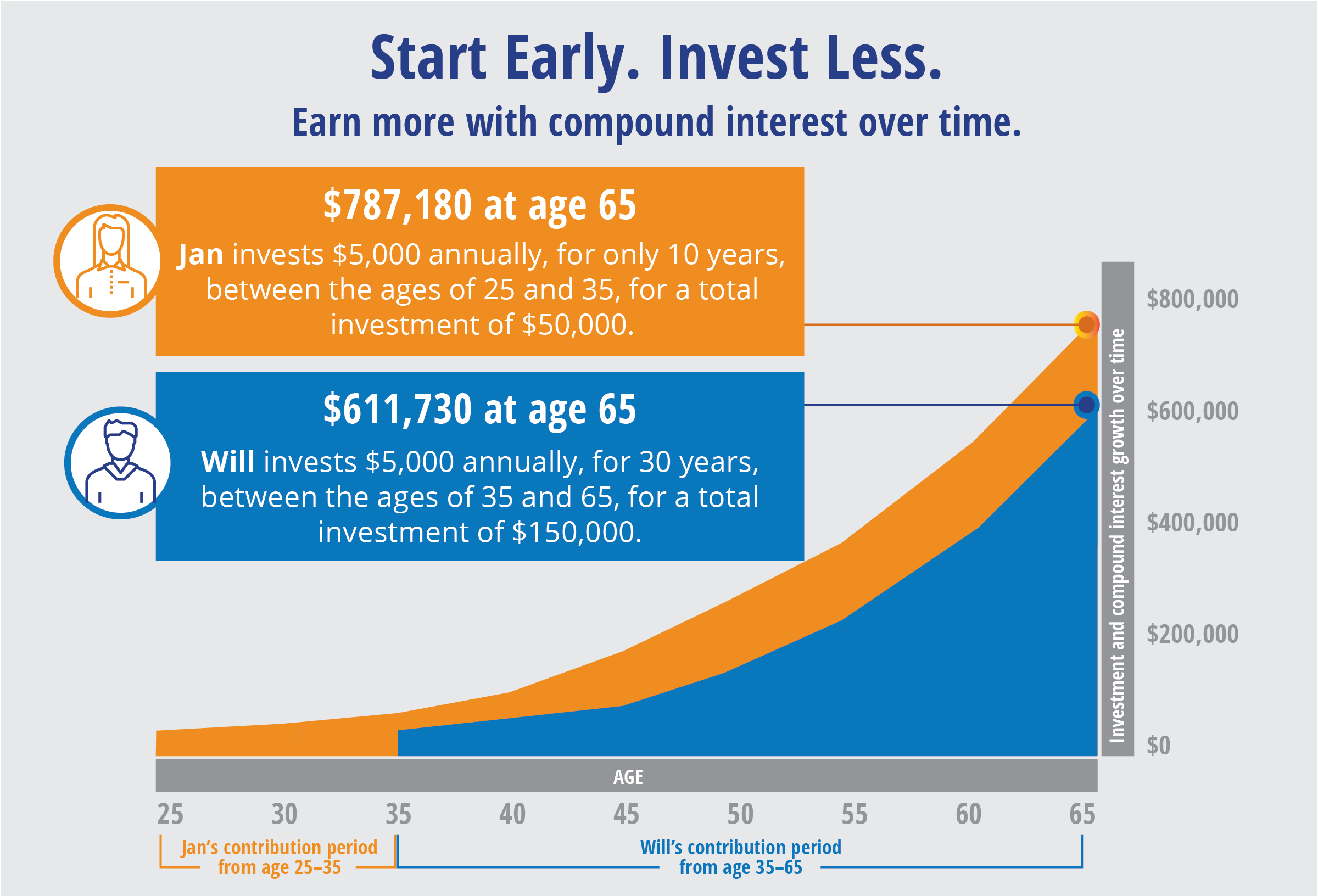

Retirement might feel like a lifetime away, but starting early is one of the smartest financial moves you can make. The earlier you begin saving, the more time your money has to grow — and that is where the magic of compounding interest comes in. Even small contributions now can turn into significant savings down the road.

What is Compound Interest?

Compound interest is like a snowball effect for your money. Over time, compound interest can make your money grow much faster than simple interest (which only calculates interest on the original amount).

Here’s how it works:

- Initial savings: Imagine you put some money in a savings account that earns interest.

- First round of interest: After a certain period (say, a year), you earn interest on that initial amount.

- The “compound” part: The next time interest is calculated you earn it on Your original money PLUS the interest you already earned.

- It keeps growing: This process repeats, so you’re constantly earning interest on a larger and larger amount.

NOTES: Example assumes an 8% interest rate, compounded annually. Balances are approximate.

KEY TAKEAWAY:

Starting early means contributing less but saving more over time with compound interest.

- Jan started saving earlier, contributing for only 10 years. She has more saved at age 65 than Will.

- Will started saving later and contributed for a longer period, 30 years until he reached retirement age. He still has less saved at age 65 than Jan.

Remember: Compound interest can work for you (in savings) or against you (in debt), so it’s important to understand how it functions!

Take Advantage of Employer Sponsored Retirement Plans

If your employer offers a 401(k) or similar retirement plan, take advantage of it — especially if they provide matching contributions. That is free money for your future! Make saving for retirement a regular habit, even if it feels far off — it will make a huge difference down the road. ZOLL sponsors a 401(k) Savings Plan through Fidelity to help you build a strong financial foundation for your retirement and matches up to 5.5% (100% of the first 4% and 50% of the next 3%).

Make Saving a Regular Habit

Saving for retirement doesn’t have to be overwhelming. Start by making it a regular habit, even if it’s just a small amount. The key is consistency. By beginning now, you’re setting yourself up for financial freedom and peace of mind later in life. Your future self will thank you!

Manage Your Investment

Ensuring your investments are on track is vital for a brighter tomorrow. ZOLL partners with CAPTRUST Financial Advisors to provide expert guidance at every stage of your journey, helping you plan with confidence.

- Schedule your FREE one-on-one call with a CAPTRUST advisor to:

- Create your personalized financial blueprint.

- Find the investment strategies that align with your risk tolerance and time horizon.

- Craft a diversified, tax-smart portfolio personalized for you.

- Regularly review your investments with your advisor to ensure you’re staying on track to meet your goals.

- Set a schedule (e.g., quarterly or annually) to evaluate your progress and adjust as needed. Changes in market conditions, new legislation, personal circumstances, or shifting priorities may require updates to your plan over time.

Journeys are not always easy — there will be times when you feel like giving up, when life knocks you down or takes you by surprise. But the true test is to keep moving forward, staying resilient through every challenge.

Maintain Your Physical Fitness

Investing in physical fitness today sets the stage for a healthier, more vibrant future.

Maintaining physical fitness throughout your life is one of the best investments you can make for your future. It may seem unusual to think about how your current health habits will shape your well-being in later years, but this forward-thinking approach can lead to a healthier future. Good health in retirement isn’t something that happens overnight, it’s the result of consistent effort and smart choices made over decades. By staying active and prioritizing fitness at every age, you can reduce the risk of chronic diseases, maintain mobility, and enjoy a higher quality of life in your golden years.

In your 20s and 30s, your body is at its peak in terms of strength, endurance, and recovery. And although you may think you are in great shape with not a care in the world, this is the ideal time to build habits that will set the stage for lifelong health.

Regular Check-ups and Screenings

Annual physical exams are essential for preventive care and early detection of potential health issues. All ZOLL medical plans include free in-network preventive care and prescription drug coverage through OptumRx to support your best health.

These regular check-ups allow your doctors to:

- Monitor changes in your health over time.

- Assess potential health risks based on family history.

- Provide personalized advice for maintaining a healthy lifestyle.

- Perform necessary preventive screenings for conditions like high cholesterol, diabetes, and certain cancers.

In addition, consider these proactive tips to prevent or delay the onset of various health conditions:

- Stay up to date with vaccinations.

- Maintain a healthy weight.

- Limit alcohol consumption.

- Avoid smoking or tobacco products.

- Protect your skin from sun damage.

By prioritizing your health today, you’re laying a strong foundation for better health in your later years.

Establish Healthy Habits

Your lifestyle choices during these years can significantly impact your long-term health. Focus on:

- Developing a consistent exercise routine.

- Adopting a balanced, nutritious diet and staying hydrated.

- Managing stress effectively.

- Ensuring adequate sleep to lessen your risk of serious health conditions and improve your overall well-being.

Remember, the habits and choices you make now can have a lasting impact on your future well-being. By combining the proactive benefits of annual checkups with the personalized support of health professionals like coaches and nutritionists, you can build a strong foundation for a healthier future.

ZOLL offers free support through Healthy Hearts! Healthy You! and Modern Health. Review the support resources at the bottom of the page.

ZOLL’s medical plans offer fitness, weight loss membership, and gym reimbursements through UnitedHealthcare and Aetna. Check them out here. Additionally, some ZOLL locations offer onsite fitness facilities. Speak to your HR Benefit Advocate to learn more.

Balance Life After Work

Finding fun and meaningful activities early in your career can help you build a foundation for balancing work and life, ensuring a smoother transition into midlife. Learning to enjoy hobbies, cultivate social connections, and explore interests outside of work allows you to recharge, maintain perspective, and develop habits that promote long-term well-being. By prioritizing leisure and self-care alongside career growth, you set the stage for a more rewarding life both during and after work.

You may already have hobbies or activities that bring you joy and fulfillment in your free time, but if you are looking to expand your horizons or discover new passions, there are countless options to explore. Engaging in hobbies outside of work can enhance your well-being, provide a creative outlet, and help maintain a healthy work-life balance. Whether you are single, building a family, or already have one, incorporating loved ones into your leisure activities can be incredibly rewarding.

For those with families, finding ways to balance work and family life is essential. This might involve family-friendly activities like:

- Outdoor games: Organize backyard soccer matches or go on family bike rides.

- Creative projects: Engage in arts and crafts or cooking together.

- Travel: Plan family vacations or weekend getaways.

For young professionals, work-life balance is not just about separating work from personal life; it is about integrating both aspects harmoniously. By prioritizing flexibility and independence, you can better manage the demands of your career while nurturing your personal life and family relationships.

Here are some additional ideas for hobbies and activities to explore:

- Get creative: Try painting or drawing, take up photography, get your hands dirty and cut food costs by gardening, fuel your cooking passion, or learn to play an instrument.

- Enjoy the outdoors: Use nature to your advantage with a hike or nature walk, go on a bike ride, take a swim, or give paddleboarding a try.

- Grow your social circle and keep your mind active: Expand your reading by joining a book club, learn a new language.

- Practice self-care: Prioritize your time with activities like the ones mentioned above or consider incorporating yoga, meditation, or mindfulness practices into your routine.

Benefits of Starting Early

Engaging in these activities early in your career helps establish routines, build skills, and create lifelong passions. By the time you reach retirement, these hobbies will already be second nature, providing structure, joy, and a sense of purpose in your daily life. Don’t stress about achieving perfection — focus on taking action and becoming the best version of yourself.

Building strong relationships and staying connected in your community is key to building a happy, healthy life — especially as you begin your career and start a family. Good social ties can help reduce stress, fight loneliness, and boost your overall well-being. Plus, having a solid support network can make tackling life’s challenges easier and even help you live longer.

Make connections part of everyday life:

- Start a walking or workout group with friends.

- Spend quality time with your partner, family, or friends each day.

- Join a club or group that matches your hobbies or interests.

- Volunteer for causes you care about.

- Attend local events, festivals, or meetups in your area.

Investing in your relationships now sets the foundation for a more balanced, resilient, and fulfilling life as you navigate your early years — and beyond.

Life can throw us unexpected challenges, and feeling overwhelmed is completely normal. The key is learning to accept change and see it as a chance to grow, rather than something to fear. This mindset — often called a “growth mindset” — can make a significant impact in your happiness and success.

What is a Growth Mindset?

People with a growth mindset see challenges as opportunities to learn, not as roadblocks. They treat mistakes as lessons, not failures, and believe that they can always improve and adapt, no matter where they start.

How can you develop a growth mindset?

- Stay open-minded: Try to approach change with curiosity. Instead of fearing the unknown, get excited about new possibilities and solutions.

- Focus on the positive: Look for the silver linings in tough situations. Focusing on what you can gain or learn helps you move forward.

- Build resilience: Bounce back from setbacks by practicing resilience. Techniques like mindfulness can help you stay calm and present when life feels unpredictable.

By practicing these habits, you will be better equipped to manage life’s changes, turning challenges into opportunities for personal and professional growth.

Navigate Your Emotional Journey

Early in your career you are likely juggling entry-level positions, managing student debt, and perhaps even beginning to think about starting a family. During this time, your sense of identity is still taking shape, and it’s easy to feel overwhelmed by societal expectations and the pressure to succeed. This stage of life is all about navigating new responsibilities while figuring out who you are and what truly matters to you.

As you navigate the early stages of your career and adulthood, it’s important to focus on building a strong foundation for your future well-being and success. Here are some key areas of focus to empower you to grow with confidence and resilience as you move forward:

- Explore who you are: This period is a great opportunity for self-discovery — defining what success means to you, rather than measuring yourself against your peers. Experiment with roles and hobbies to uncover your values and strengths.

- Set boundaries: Establishing healthy boundaries helps you prioritize commitments and experiences that align with your personal goals. Avoid getting caught up in work alone; instead, say “yes” to meaningful opportunities like travel, pursuing a side hustle, or starting a family, and focus on what truly matters to you.

- Develop a support system: A reliable support system that includes mentors, friends, or professionals, can help you be better equipped to handle challenges like workplace stress, self-doubt, or the transition to parenthood.

Take advantage of free, confidential coaching from Modern Health. Certified coaches will use evidence-based techniques to help you maintain accountability and work through your personal and professional goals.

Embracing lifelong learning and pursuing intellectual curiosity is crucial for mental well-being at every stage of life. As you navigate early adulthood, stimulating your intellect can set the stage for a lifetime of growth and opportunity. This is a critical time for career development and establishing habits. Engaging your mind combats stress, enhances problem-solving skills, and opens doors to new experiences.

Consider starting these healthy habits now to enhance your cognitive abilities, charting the course for a sharp and engaged mind for years to come.

- Read books and articles to expand your knowledge and be open to new subjects.

- Take courses or workshops to learn new skills, fuel your curiosity, and provide new experiences.

- Explore creative outlets: Write, paint, or play music to reduce stress and unlock innovative thinking.

- Engage in puzzles and games to sharpen critical thinking and problem-solving.

- Practice mindfulness to reduce stress and improve focus.

Learning to manage stress early on is an investment in your long-term well-being. The habits you develop now, such as setting boundaries, practicing self-care, and seeking support when needed, will serve as a foundation for resilience as you navigate the increasing demands of midlife and the transitions of retirement. Prioritizing your mental health now not only enhances your immediate quality of life but also equips you with the tools and coping mechanisms to thrive through every stage of your journey.

Make Self-care A Priority

No one knows you better than you do. Tuning in to your emotions is key to maintaining well-being. When you notice how you feel, you’ll know when it’s time to reach out for support. Try these self-care suggestions to help you stay balanced and resilient:

- Prioritize rest and nourishment: Chronic sleep deprivation can contribute to depression and anxiety and can impair cognitive functions like decision-making and problem-solving. Aim for seven to nine hours of consistent quality sleep. And to further support your mind and body, eat a balanced diet rich in fruits, vegetables, and whole grains.

Do you have a sleep condition? You may be eligible to participate in a free Home Sleep Apnea Test through Healthy Hearts! Healthy You!

- Stay active and engaged: Regular physical activity, creative hobbies, and mentally stimulating activities like puzzles help reduce stress, boost your mood, and keep your mind sharp.

- Practice mindfulness and set boundaries: Use mindfulness techniques such as meditation or deep breathing to calm your mind and protect your energy by saying no to draining commitments.

- Take breaks and practice gratitude: Step away from work regularly to recharge. Take time each day to appreciate the positives in your life to build optimism and resilience.

- Connect and know when to seek support: Spend time with loved ones, join community groups. If you find yourself feeling more stressed or anxious than normal, ask for help.

Reach out to Modern Health for free, confidential support with a coach or therapist.

Find Support When You Need it

Your ZOLL benefits include free resources designed to help you navigate life’s challenges, manage stress, set meaningful goals, and build confidence in your daily decisions. Take advantage of these tools to support your well-being and empower your journey every step of the way.

Modern Health

Modern Health offers mental wellness support to you and your dependents, including access to personalized one-on-one, group, and self-serve resources for your well-being, so that you can be the best version of yourself — at home, at work, and in your relationships. Modern Health coaches can help you manage a wide range of situations that may come your way, including stress, relationships, parenting, personal growth, financial well-being, and professional development, among many others. Should you need additional support, licensed professionals are available to assist one-on-one with more serious concerns such as depression and anxiety.

Healthy Hearts! Healthy You!

ZOLL’s free wellness program, Healthy Hearts! Healthy You!, is designed to give you an accurate picture of your current health and provide you with a roadmap for how to maintain or improve your well-being. You can participate in free health coaching, take a Home Sleep Apnea Test, and access personalized support to meet your wellness goals. You do not need to be enrolled in a ZOLL medical plan to participate. All ZOLL full-time employees (30+ hours per week) and spouses are eligible to participate in the program and earn rewards. In addition, by participating in and meeting the requirements, you and your spouse could each earn points toward an annual reward of $500.

NEED MORE INFORMATION ON THIS BENEFIT?

Refer to the quick links buttons to the right.