Be the Star of Your Own Life in 2026!

At ZOLL, we’re committed to keeping health care affordable and flexible while continuing to invest in programs that matter most – giving you and your family the support you need physically, emotionally, and financially.

Get Your Questions Answered

Get a preview of what’s ahead. Watch a recorded version of the virtual Open Enrollment meeting to learn more about your 2026 plan options and get your questions answered. Click here to watch.

Join Alyson and her guest, Annemarie Silver, to learn how simple and affordable health care can be with Surest.

This year’s spotlight shines on…

Benefits that help you take center stage – making care simpler, supporting your family, and strengthening your well-being:

- Surest Plan – A simpler way to manage health care costs – whether just for you or for your family.

- Modern Health – Emotional well-being resources for individuals, couples, and families.

- Maven – 24/7 support for women’s health, parenting, fertility, adoption, surrogacy, and family planning.

“Surest helps me be more proactive with my health by giving me a clear idea of costs upfront and helping me find more affordable options.”

Your Medical Plan Options

ZOLL offers three medical plans so you can choose the coverage that works best for you and your family: the Surest Plan, Saver Plan with HSA, and PPO Plan.

Surest: A simpler way to get care

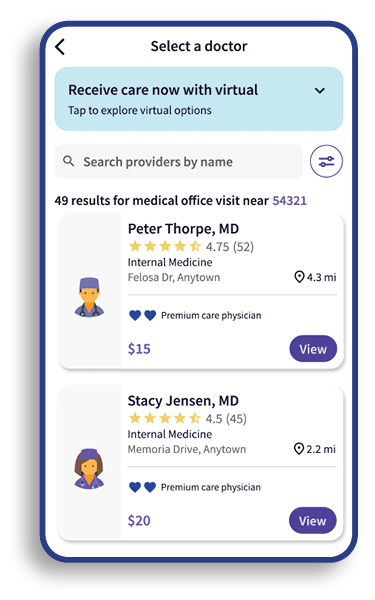

Surest is a medical plan that puts you in control. You’ll always know what you’ll pay before you go, with no deductibles or coinsurance to manage.

Visit the Surest pre-member website and enter access code ZOLL2026 to:

- Search for your current providers or other in-network providers to see the cost of services.

- Search by condition, or type of service, and Surest will help you find local providers.

- Schedule a personalized consultation with a Surest representative to learn how the plan could benefit you and your family.

Want to learn more about Surest?

Watch these videos to learn how the Surest Plan works.

Click below for quick access to the Open Enrollment

support you need!

support you need!

Want Help Comparing Your Options?

Pasito, your personal decision support tool, makes it easy to see how all three medical plans – Surest Plan, Saver Plan with HSA, and PPO Plan – stack up based on your health needs and budget. In just minutes, you’ll get personalized recommendations, side-by-side costs, and simple guidance to make your choice with confidence.

Visit Pasito to get your initial recommendation today!